An increase in the value of assets is a debit to the account, and a decrease is a credit.

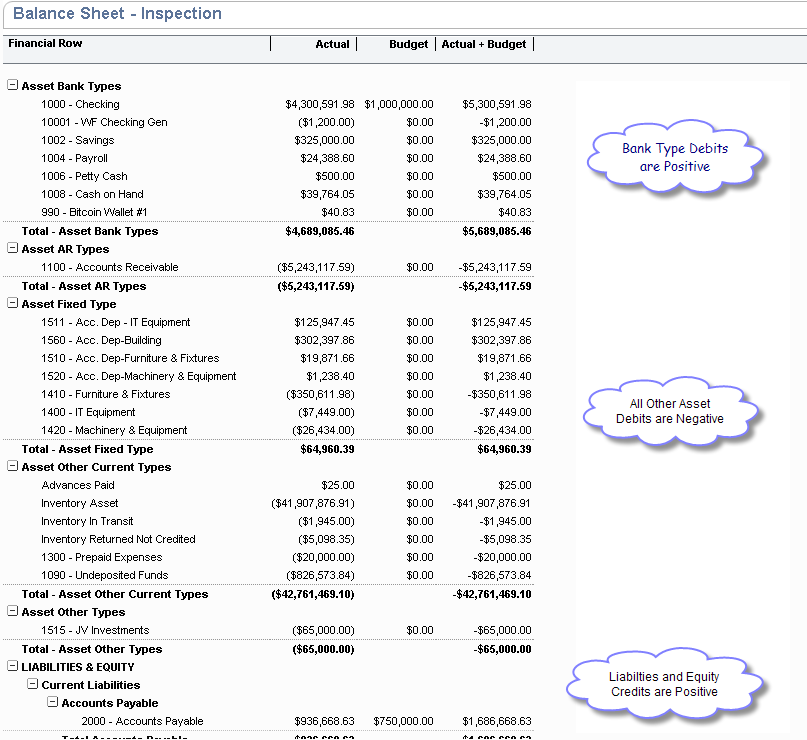

#Debit credit balance sheet plus#

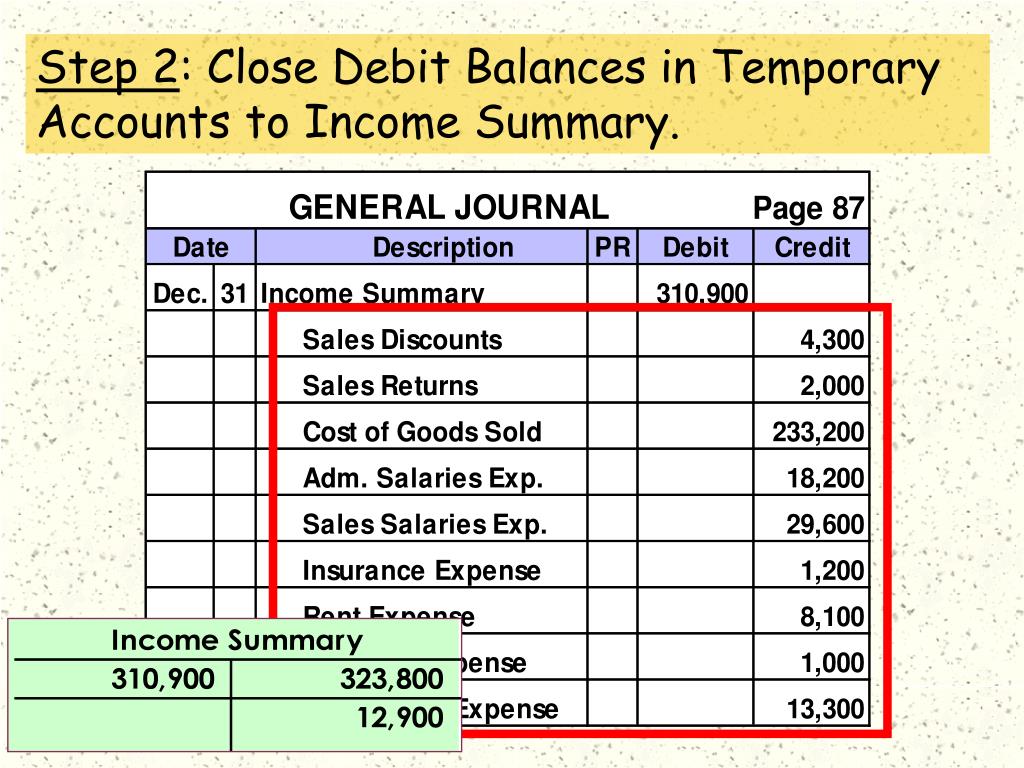

On a balance sheet or in a ledger, assets equal liabilities plus shareholders' equity. If you debit one account, you have to credit one (or more) other accounts in your chart of accounts. In a double-entry accounting system, every transaction impacts at least two accounts. Asset and expense accounts are increased on the debit. Debits and credits are bookkeeping entries that balance each other out. It is equally important to note that with the equation Debits Credits, the left side must always contain debits, and the right side must contain only credits. Let's review the basics of Pacioli's method of bookkeeping or double-entry accounting. Whether a debit or a credit increases or decreases an account balance depends on the type of account. Using the double-entry method, bookkeepers enter each debit and credit in two places on a company's balance sheet.A decrease in liabilities is a debit, notated as "DR.".

0 kommentar(er)

0 kommentar(er)